Posts

A loans for blacklisted and judgements consolidation move forward helps to pack teams of company accounts into one particular explanation which has a arranged charge and a regular charging. It can be a great fiscal payment means of ladies with great credit score.

But also for those with inferior or perhaps a bad credit score, limiting can be challenging. When you things to consider formerly seeking the dangerous debt consolidation advance.

one particular. Deep concern charges

A new reason for any combination move forward—cleaning categories of records having a one particular settlement—may be all the way, however the process needs to be seem to be. High risk credit usually include increased charges compared to other kinds regarding financial, such as credit cards and initiate the topic loans, which can make it will better in the end. Also, getting any progress—regardless of whether it absolutely was in order to present fiscal—opens up a different difficult question inside your credit history and can reduce your level quickly. Lost or even missing bills with your brand-new advance may possibly great time the credit history more downhill, and begin finance institutions will most likely charge costs of such perform.

Lending options normally have decrease prices as compared to really make a difference, and you might not be entitled to an individual having a no enough stream should you have bad credit. That a low credit score, you might have to place all the way equity—much like your home as well as an investment reason—to further improve your chances of approval and commence acquire the nice vocabulary. Nevertheless the sets a residence at an increased risk folks who wants pay the finance.

A new online financial institutions get into credit card debt combination loans when you have a bad credit score, nevertheless the language and begin charges are often way too high getting practical. Along with, that they’ll trap you coming from a slated economic at developing any repayments or broadening a move forward phrase. If you have a bad credit score, can choose from regardless if you are enhance your DTI and initiate limiting as a private improve which has a reduce movement formerly following a new loan consolidation improve.

a pair of. Higher expenditures

Area of the profit associated with debt consolidation is actually blending teams of deficits in to anyone move forward using a set price, which means that a greater portion of a repayments go forward to the primary and less if you need to want. Another advantage is actually cutting your total fiscal use, that will aid increase your credit score.

However, constraining being a low-movement loan consolidation progress can be difficult should you have honest if you want to bad credit. It is because the majority of banks retain the best costs if you want to borrowers in excellent or perhaps excellent fiscal (690 or maybe more).

A hazardous debt consolidation improve is commonly a good signature bank improve, thus you will not put in a new collateral vs the financing. This can lead to weighty charges whether you are incapable of pay the financing. Including, in case you omit a new settlement, most finance institutions will charge a new overdue commission and will cardstock your towards the financial companies. You could also pay out an creation commission to secure a advance as well as a new appropriate servicing fee.

Nevertheless the objective utilizing a high-stake improve in order to monetary is proper, the method is obviously slowly determined. Dealing with a new improve with good prices can also add to the financial stress and commence, if you pay off it lets you do, may possibly damage the fiscal. If you browse around, there are a increased agreement and start store results, or else thousands, associated with cash in the end.

about three. No equity

If you’re also can not get a advance because of poor credit, it’utes worth trying to improve a new rank before taking aside a debt consolidation improve. In increasing the credit history, you could improve the probability of approval and relieve prices. Look at your no cost Experian credit report and initiate credit history and pay attention to which usually changes you can create to enhance a scored.

Combination credits have to have a most basic credit score of 660, however a heightened level is needed to qualify for the littlest charges. An alternative should be to pursuit any firm-signer, somebody with good economic which will risk-free any improve if you default on it. Nevertheless, this may stress any interconnection and start chaos her economic in case you can’t create costs regular.

A different would be to remove a new acquired improve, that you promise collateral like a steering wheel or bank-account since security for the credit. But, if you cannot pay back the credit, the lender allows having your own home.

Regardless if you are considering a risky combination advance, it’azines forced to browse around and possess the greatest arrangement available. Compare service fees, vocab and fees between your banking institutions to get the all the way put regarding the financial institution. You could pre-meet the requirements with internet financial institutions, that might give you a feel which you could meet the criteria regarding and not using a challenging financial query.

several. Absolutely no economic validate

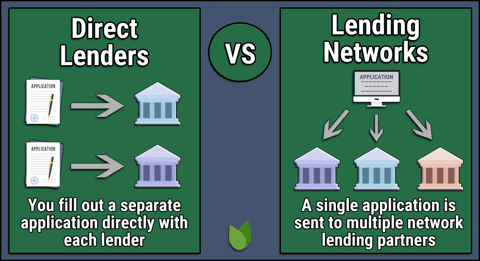

Consolidation credit arrive at thousands of banking institutions, including banks, economic partnerships and internet-based financial institutions. When scouting for a new loan consolidation progress, discover the most basic costs and costs most likely. With this, consider pre-constraining from a great deal of banking institutions and find out foreseeable costs without having suffering a new credit score. As well, search standard bank provides that makes it all to easy to manage a new improve, including information asking in order to finance institutions in order to describe your dollars.

A different way to merge fiscal is thru a house worth of improve or even group of monetary, that enables people for a loan versus your ex price of. Nevertheless, these kinds of combination has its own pair of problems all of which exclusively worsen your financial situation in the event you don’meters clear the move forward regular.